After years of turbulence and transformation, Cambodia’s property sector is tentatively entering a new phase. The high-octane, foreign investment-driven boom of the 2010s has slowed to a cautious walk. In its place, a more localized, pragmatic market is beginning to emerge—defined not by skyline-altering megaprojects, but by affordability, adaptability, and resilience.

The first quarter of 2025, as captured in CBRE Cambodia’s most recent Market Insights report, is marked by a curious duality. On one hand, Cambodia’s macroeconomic signals are broadly positive: GDP growth is forecast at 5.5%, tourism arrivals are climbing, and foreign direct investment remains healthy. On the other hand, the global headwinds—particularly from the re-imposition of U.S. trade tariffs under a second Trump administration—are stiffening fast. And local developers, weary from a sluggish half-decade, are now forced to reckon not only with economics, but also with seismic risk—both literal and financial.

This article dives deep into CBRE’s Q1 2025 findings, focusing on the national overview and the residential real estate segment, to explore what’s truly shifting in Cambodia’s housing market—and what it may take to weather the next storm.

The Economic Context

In early 2025, Cambodia’s economic landscape is characterized by restrained optimism:

- GDP growth is projected at 5.5% by the World Bank, up from 5.3% in 2024. The government is even more optimistic, forecasting 6.1%, while the IMF and ADB predict 5.8% and 6.0%, respectively.

- Inflation remains low, at 2.6% (Q1 2025), reflecting continued price stability in consumer goods and services.

- The tourism sector—a bellwether for real estate and retail—posted a promising 1.26 million international arrivals in the first two months of the year alone, a significant climb over pandemic lows.

- Foreign Direct Investment (FDI) reached $4.2 billion in 2024, up from $3.6 billion in 2023, largely driven by ongoing Chinese investment, which made up 50% of total FDI last year.

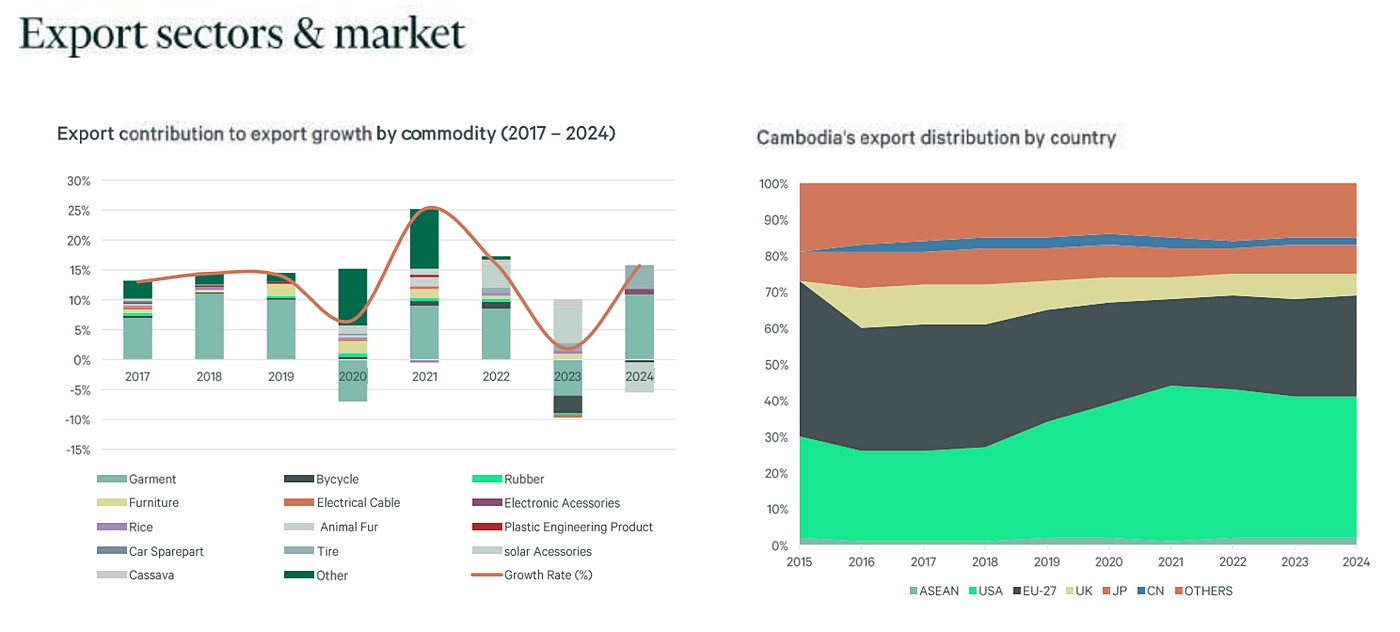

Yet this cautious optimism is being undermined by an evolving geopolitical backdrop. The Trump administration’s reinstatement of protectionist trade policies has direct implications for Cambodia. With over 30% of Cambodian exports destined for the U.S., and garment manufacturing contributing 16.9% to GDP growth in 2024, new reciprocal tariffs—set at an average of 49%—could be deeply damaging.

Residential Sector

After several years of uncertainty, Cambodia’s residential property market appears to be stabilizing, if not accelerating. The rapid, skyline-shaping growth of the last decade—largely driven by international investors and speculative buying—has now given way to a quieter, more practical reality. The market in early 2025 is no longer defined by overseas capital or luxury skyscrapers, but by affordability, end-user demand, and cautious optimism.

As detailed in CBRE Cambodia’s Q1 2025 Market Update, the country’s residential sector is undergoing a structural transition. Developers, lenders, and homebuyers are all adjusting to a new normal shaped by economic shifts and demographic needs. The result is a sector in recovery—but also one that is starting to reflect Cambodia’s domestic aspirations more clearly than ever before.

A Surge in Local-Focused Residential Development

The first quarter of 2025 saw a notable uptick in new residential launches, particularly in segments that cater to Cambodian end-users. Unlike previous years, when high-rise condominiums were aimed squarely at overseas buyers, current launches are increasingly mid-range or affordable in nature, with compact unit layouts and flexible payment terms.

Two key high-rise condo projects launched during the quarter L Tower 3 in TTP and Piphup Thmey Condo Sensok demonstrate this shift. Both are positioned at the mid-range level and aim to tap into local demand. Piphup Thmey Condo Sensok marks a significant entry for a developer previously known only for landed property, signaling that even established players are diversifying toward vertical formats.

Landed property development has also regained momentum, with over 1,400 new landed units launched in Q1 alone. These include:

- ML Scenery, a mid-range development;

- Chip Mong Grand Land 271, an expansion of a well-known borey along Road 271;

- and Morakot Village – a new high-end project from Borey Peng Huoth.

This new supply reflects a broader range of pricing and formats—from affordable boreys under $40,000 in areas like Dangkor and Preaek Phnov, to luxury villas exceeding $200,000 in Koh Norea and Chroy Changvar.

The Case of Piphup Thmey Condo Sensok: A Turning Point

One project in particular captured the market’s attention: Piphup Thmey Condo Sensok , launched in January 2025. Developed by a new joint venture, the project offered 800 compact condo units priced between $17,000 and $25,000, with monthly installment plans starting at just $150–$170.

The response was immediate: over 500 units sold within three days.

According to CBRE analyst Kimsea Chea, the project’s success offers powerful insight into the Cambodian housing market’s evolving dynamics. Buyers were overwhelmingly young Cambodian couples and first-time homeowners—a demographic previously sidelined by the dominance of high-cost, investment-grade developments.

Piphup Thmey Condo Sensok succeeded not because of lavish amenities or luxury finishes, but because it struck the right balance of location, size, price, and payment structure. Its compact 20–30 sqm units are a departure from the 90–120 sqm layouts common during the boom years. The project demonstrates that if pricing aligns with income, Cambodians are not only open to vertical living—they are eager for it.

Construction Pace and Completion Volumes

Despite growing interest, actual completions in Q1 remained modest.

In the condominium sector, only one mid-range project was completed. Most developments remain cautious, pacing their construction schedules to match sales volumes and financing conditions.

Landed property completions were similarly subdued. Only around 10% of the year’s projected new supply was delivered in Q1, though this is consistent with the sell-to-build model prevalent in the borey market.

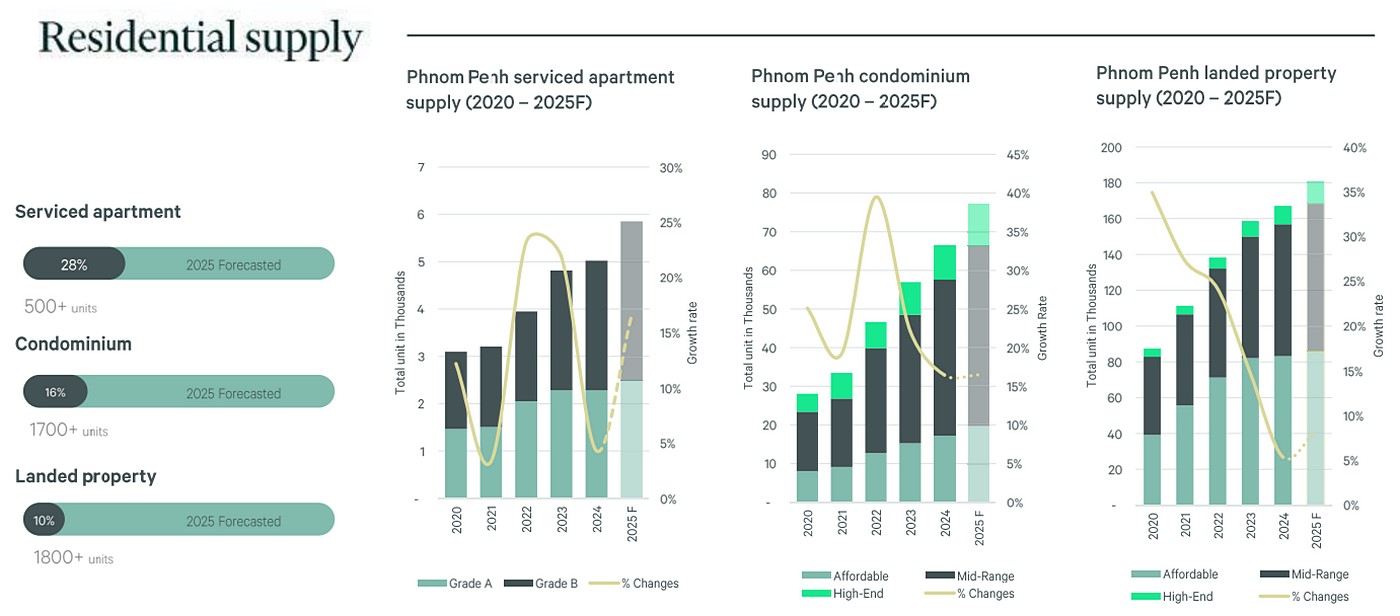

The service apartment segment bucked the trend, with two major projects—Grand Mansion (BKK1) and Wyndham Grand Phnom Penh Capital (Chroy Changvar)—adding 540 new units to the city’s hospitality-residential hybrid stock. This brings total service apartment growth to 28% of the 2025 forecast—just one quarter into the year, raising questions about potential oversupply in the mid to high-end range.

Pricing and Rental Trends Reflect a Stabilizing Market

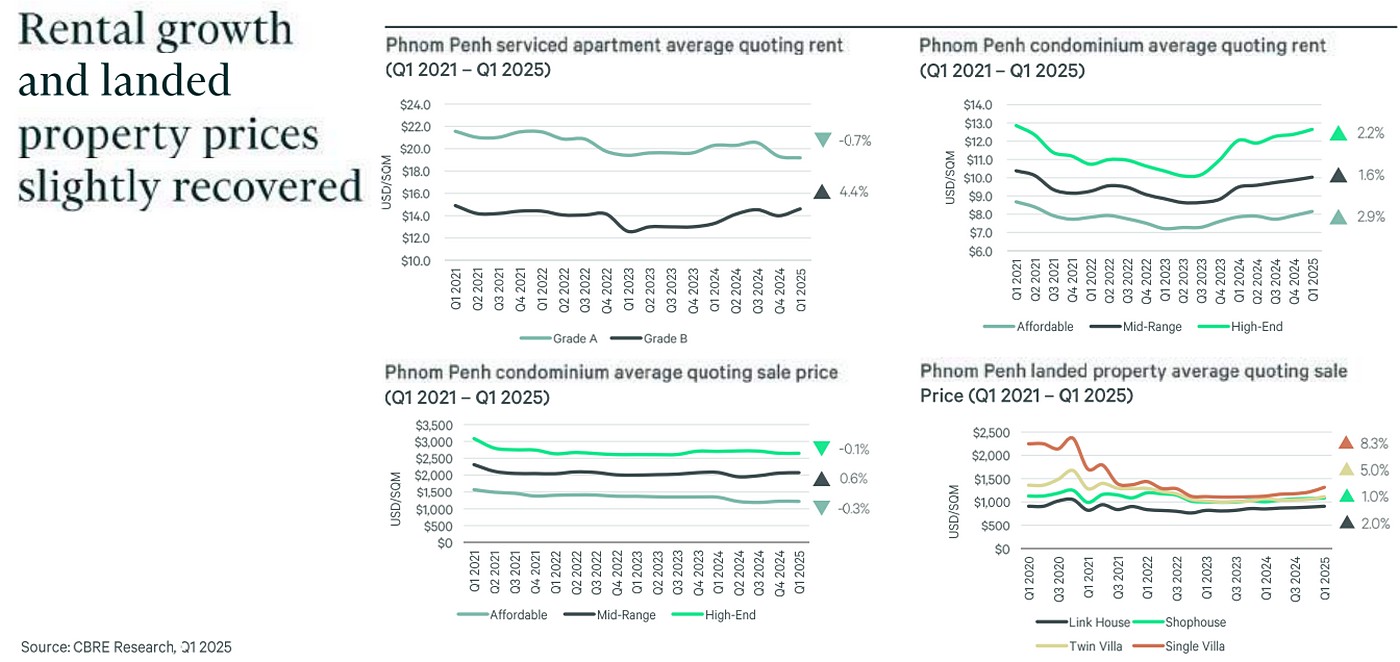

Property prices across the residential sector remained mostly flat in Q1, with only minor variations across different categories.

Condominium Sale Prices:

- High-end condos averaged $2,648 per sqm, unchanged quarter-over-quarter.

- Mid-range condos held steady around $1,438 per sqm.

- Affordable condos saw a slight dip to $1,010 per sqm, influenced by the entry of lower-cost projects

Rental Rates:

- Affordable condos saw a 2.2% increase in rents, now averaging $8.3/sqm/month.

- Mid-range condo rents rose 1.6% to $11.4/sqm/month.

- High-end condo rents rose 2.9%, reaching $13.6/sqm/month

In contrast, service apartment rents declined 4.4%, particularly in the Grade B category. With more condominium owners entering the rental market and offering similar amenities at lower rates, service apartments—once favored by expats and corporate tenants—are facing heightened competition.

Financing Environment Remains Cautious

There are signs that personal housing loans are rebounding—but CBRE notes that much of this may still reflect refinancing, not new borrowing. Lenders remain cautious, especially when it comes to financing real estate development.

While bank deposit growth remains strong—up to 15% YoY—loan disbursement is focused on strategic sectors like logistics, light industry, and agriculture. New real estate loans are scrutinized more tightly, particularly for projects targeting speculative buyers or those lacking strong presales.

Outlook: A Real Estate Market Grounded in Local Reality

The residential market in Cambodia is unlikely to return to the breakneck pace of the 2010s anytime soon. But that may not be a bad thing. What’s emerging instead is a more balanced, locally attuned housing sector—one defined by affordability, smaller footprints, and demand-led development.

Projects like Piphup Thmey Condo Sensok are showing the way forward, proving that if the product is right, the buyers are ready. With infrastructure continuing to improve—such as the upcoming Techo International Airport and new expressway corridors—accessibility and suburban demand are expected to rise.

For developers and investors, the key takeaway is clear: Cambodia’s housing market is regaining momentum, but on new terms. Understanding local buyer behavior, pricing expectations, and regulatory risks will be essential to sustainable success in the years ahead.

Based on CBRE Cambodia Q1 2025 Market Insights, See full video at:

Ta strona jest także dostępna w językach:

![]() Polski (Polish)

Polski (Polish)