Phnom Penh, October 2025 — The latest Market Insights 2025 presentation by CBRE Cambodia offered a detailed snapshot of the nation’s economic and property landscape. The findings, drawn from macroeconomic indicators and real estate data, paint a picture of a country maintaining cautious stability amid global uncertainty, while its housing market evolves toward practicality, affordability, and domestic demand.

Economic Outlook: Steady Hands in Turbulent Waters

A Stronger Khmer Riel and Easing Inflation

The Khmer Riel has proven unexpectedly robust through 2025, holding within the narrow band of 4,100–4,150 per US dollar for much of the past few years. Over the past year, it even appreciated slightly against the dollar, a movement mirrored in neighboring currencies such as the Vietnamese Dong and Thai Baht. The strengthening Riel points to both a weaker greenback and rising regional resilience.

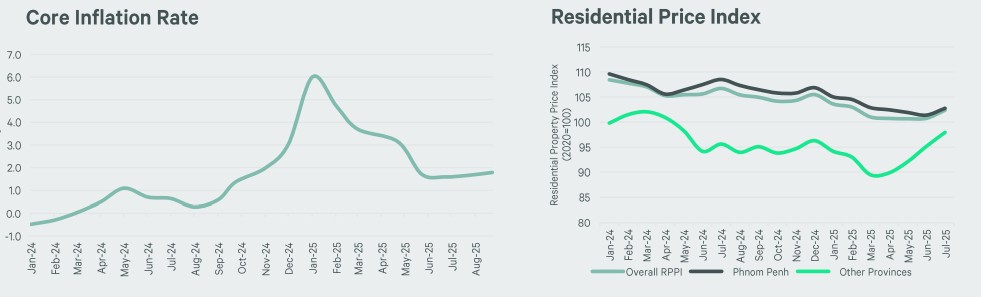

Meanwhile, inflation — once a major concern — has eased noticeably. After peaking early in 2025, core inflation began to taper through midyear and continues to stabilize toward year’s end. The adjustment suggests that price pressures are moderating as supply chains normalize and global commodity volatility wanes. For businesses and households alike, it signals a more predictable financial environment than that of recent years.

Property Index Gradually Rising

Data from the National Bank of Cambodia show a modest increase in the residential property price index, led primarily by Phnom Penh and nearby provinces. The rise, while small, reflects an undercurrent of recovery in the housing market. However, analysts caution that the dataset includes only transactions financed by banks — omitting a large volume of cash and developer-financed purchases that dominate Cambodia’s real estate sector. Even so, the upward movement adds a note of optimism after a prolonged lull.

Interest Rate Spread Reveals Banking Caution

A clear divergence remains between deposit and lending rates. Term deposits currently average around 6–7%, while loan rates for new borrowers still hover near 11–12%. The gap underscores the cautious stance of banks, which remain liquid but conservative, preferring to preserve reserves rather than take on additional credit risk in an uncertain investment climate. Businesses continue to find borrowing costs high, a factor that could constrain short-term growth even as overall liquidity remains abundant.

Trade Softens After a Strong Rebound

Trade activity — one of the economy’s central pillars — has lost some momentum. Following a strong post-pandemic recovery through 2024, both imports and exports declined by roughly 8% in 2025. The trade deficit persists at about 6% of GDP but appears to be narrowing as imports slow faster than exports. The slowdown reflects weaker global demand, shifting supply routes, and the lingering impact of tariff adjustments between Cambodia and its key trading partners.

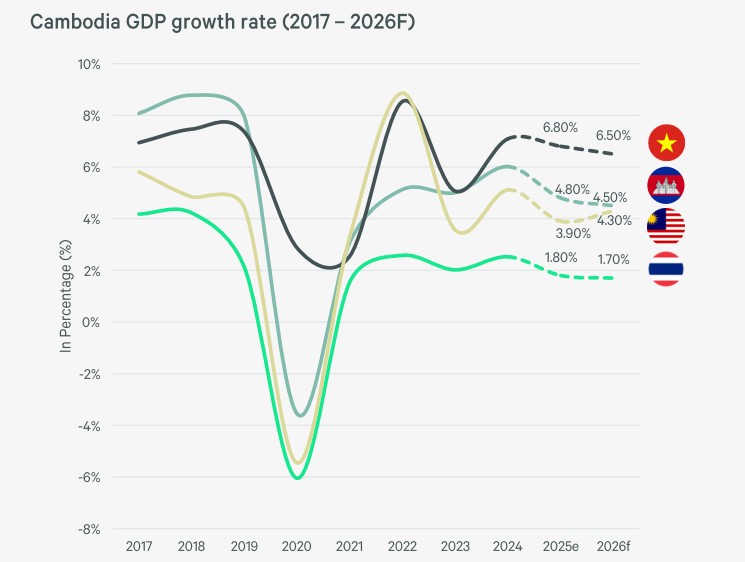

Growth Forecasts Trimmed Across the Region

The country’s GDP is projected to grow by 4.8% in 2025 and 4.5% in 2026 — a moderate pace that places Cambodia in the middle of the regional pack. Vietnam remains the standout performer, with forecasts near 6.8% this year. Across Southeast Asia, most growth projections have been revised downward in recent months, except for Singapore, which has held steady. The revisions highlight a broader regional deceleration as global trade and investment remain subdued.

A Nation of Savers

The country’s money supply has expanded from around $50 billion to $60 billion over the past two years — an indication that liquidity remains solid. Yet the composition of these funds suggests restraint rather than exuberance: fixed deposits and foreign-currency holdings dominate. Households and businesses appear to be favoring savings over spending, a pattern reflecting caution in the face of both political and economic unpredictability. This trend, while dampening immediate consumption, contributes to long-term financial stability.

Infrastructure Drives Forward Momentum

Infrastructure continues to serve as Cambodia’s key economic driver. The partial opening of the Techo International Airport in the third quarter marks a major milestone for national logistics and tourism. Full inauguration is expected by year-end. Beyond aviation, ongoing projects — from expressways to industrial corridors — are reshaping the geography of development, lowering transport costs, and expanding the city’s footprint. These new arteries are already attracting residential and commercial investment, particularly south of Phnom Penh, where once-peripheral zones are fast becoming new urban centers.

Residential Property: From Luxury Dreams to Livable Realities

Affordable and Mid-Range Segments Take the Lead

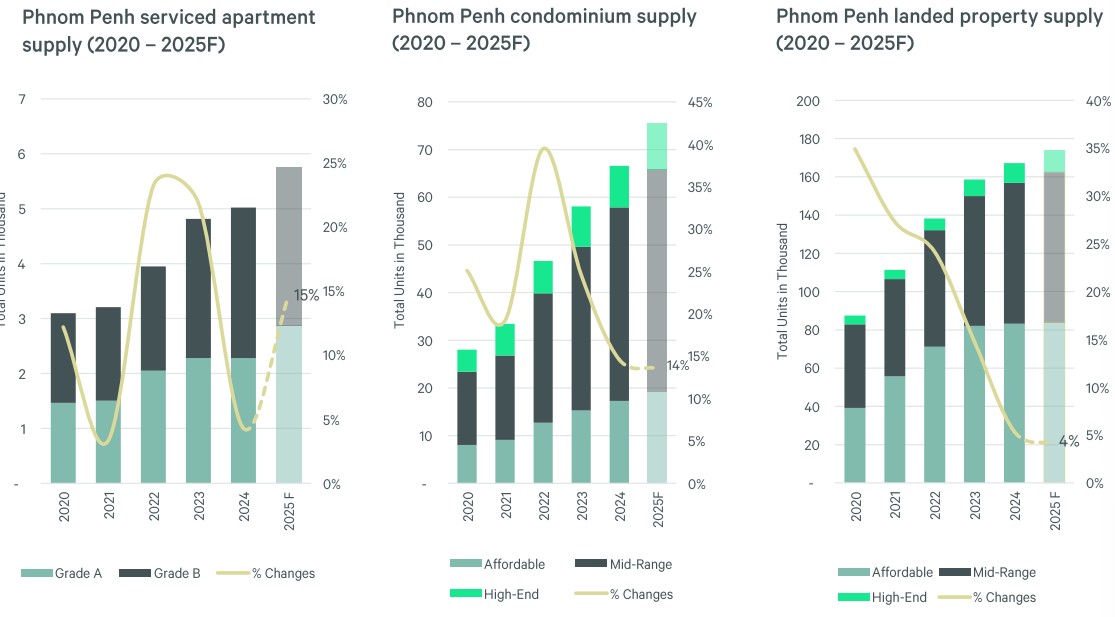

Cambodia’s housing market is undergoing a quiet transformation. The era of speculative high-end towers is giving way to a more measured phase dominated by affordable and mid-range housing. Developers are pivoting toward practical products aimed at local families and middle-income earners rather than relying on foreign investors.

In the third quarter of 2025, two new affordable condominium projects entered the market, collectively adding about 1,200 units, while two mid-range developments — Urban Village Phase 2 and Crown Tower — were completed, adding 1,400 units. Most of this activity is concentrated in the southern districts of Phnom Penh, which are benefiting from improved transport links and proximity to the new airport. These areas have become the city’s most active development corridors.

A Glimmer in the High-End Segment

Although subdued, the luxury market is not entirely dormant. A new project, Citadel Manor, was announced as a forthcoming high-end condominium — the first such launch in years. Its emergence may signal that investor confidence in the upper segment is slowly returning, though for now, momentum remains firmly with the more accessible end of the market.

Landed Property: The Local Favorite

If condominiums have slowed, landed property — the preferred choice for Cambodian buyers — continues to thrive. Developers are rolling out new phases of affordable and mid-range housing estates, following infrastructure expansion into the city’s periphery. Around 300 new landed homes were launched this quarter, alongside four project completions totaling more than 800 units. South Phnom Penh again leads in activity, reflecting how infrastructure and urban expansion are reshaping residential patterns.

Few high-end landed developments launched this year, added only a modest number of units, underscoring the current tilt toward attainable housing. The shift away from speculative luxury estates is unmistakable — and healthy for long-term sustainability.

Service Apartments and Branded Residences

The serviced apartment sector remains stable but selective. Only a few new openings are recorded each year, maintaining a steady supply pace. The most notable recent addition is Bassac Signature , a 40-unit property near the Bassac Lane district. Though limited in volume, such developments reinforce Phnom Penh’s position as a rising hub for professionals and expatriates seeking flexible, high-quality accommodation.

Branded operators are also gaining influence, with global names preparing to enter the local market. The anticipated arrival of the Ritz-Carlton Residences, though yet to be confirmed, exemplifies growing international attention toward Phnom Penh’s maturing hospitality-residential segment.

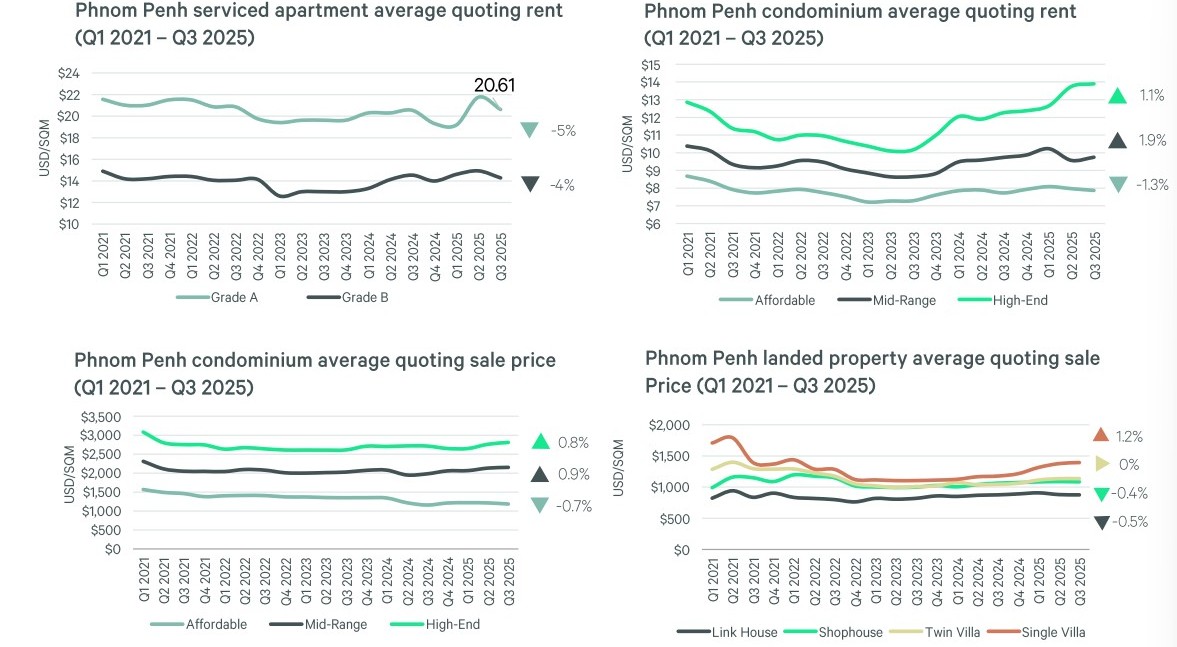

Rents and Prices: Stabilization Takes Hold

Rental and sales prices across the housing spectrum show signs of stabilization after several volatile years. Condominium rents have inched up slightly — about 1–2% in mid- and high-end categories — while affordable units saw small declines as developers adjusted pricing to attract tenants. Landed properties, particularly single villas, have retained strong values, with some even appreciating amid tight supply and persistent local demand.

Serviced apartments, by contrast, registered a mild decline in rental rates, slipping 4–5% as they faced tougher competition from newly completed condominiums offering lower long-term leases. Tenants staying under six months still favor serviced options for convenience, but those committing to a year or more are increasingly turning to condos for cost efficiency.

Sales Trends and Developer Adaptation

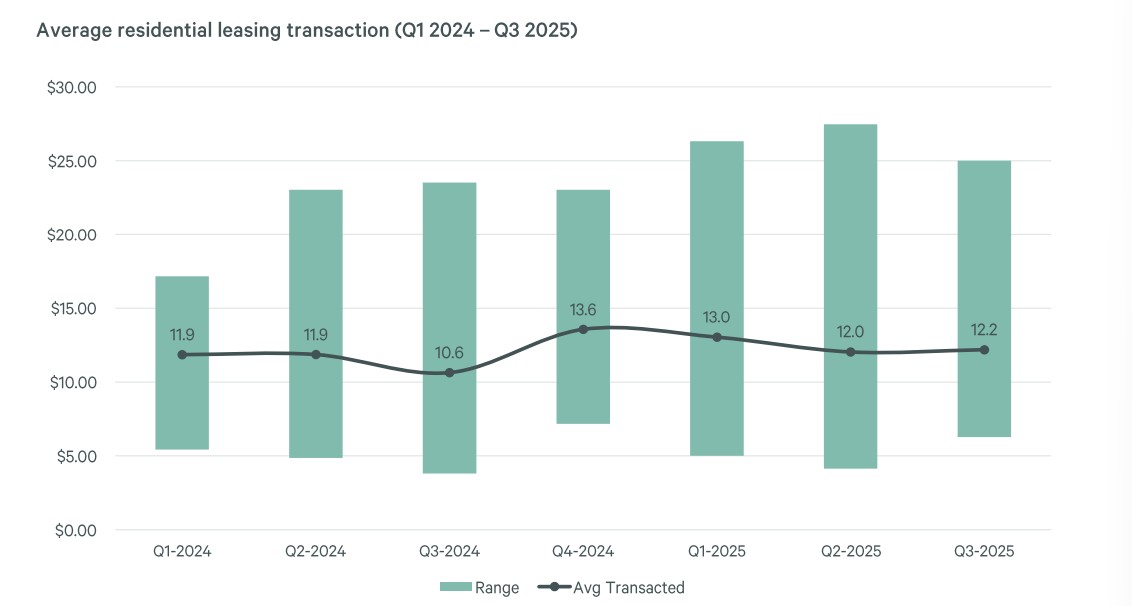

Transactions have stabilized, with average rents for residential leases hovering around $12 per square meter. The upper range of transactions has shown a gradual uptick, signaling a cautious recovery in leasing demand.

Developers are adapting to shifting buyer behavior through flexible financing. Extended installment plans, low down payments, and deferred schedules are now standard tools to sustain momentum. Such incentives have been vital for maintaining cash flow and supporting both developers and buyers in a high-interest-rate environment.

Building Along the New Arteries

The southward march of Phnom Penh’s development continues to shape the property map. Residential zones are clustering near major roads and transport hubs, following the logic of new accessibility. Projects that once seemed far-flung are now within easy reach of the city’s business districts. This trend marks a strategic evolution: the capital is gradually transitioning from a high-rise downtown market to a network of suburban enclaves built for functionality and community living.

Domestic Demand at the Core

A defining feature of the current cycle is the rise of local buyers. Where once the market relied heavily on overseas investors, particularly from China, Singapore, and Korea, today’s transactions are increasingly driven by Cambodian households. This structural shift has anchored the market in domestic realities and reduced its vulnerability to external shocks. Developers are designing homes not for speculation but for occupation — a sign of a more mature and sustainable market.

Key Takeaways: Practicality Over Prestige

The transformation underway reflects both necessity and evolution. Affordable and mid-range developments are thriving because they align with actual purchasing power. Flexible payment terms are ensuring that genuine buyers can enter the market. Developers who once targeted speculative luxury investors are now competing on livability, design quality, and pricing realism.

Following major infrastructure projects — notably the new international airport and connecting expressways — residential growth is spreading outward, creating new submarkets and redistributing the city’s density. The direction is clear: Phnom Penh is expanding horizontally rather than vertically.

A New Phase of Measured Growth

Cambodia enters the final quarter of 2025 with a sense of cautious confidence. The economy remains stable despite trade softening and geopolitical headwinds. Inflation is under control, the currency is firm, and infrastructure continues to drive national progress.

In the property market, the message is equally clear: the speculative boom years have given way to consolidation and pragmatism. The focus has shifted from luxury to livability, from external investors to domestic buyers, and from short-term gains to long-term sustainability.

The changes may seem subtle, but they mark an important evolution — the emergence of a more grounded, resilient economy that is learning to grow on its own terms.

all charts by CBRE

Full report available here

Ta strona jest także dostępna w językach:

![]() Polski (Polish)

Polski (Polish)