Summary

Cambodia’s economic and real estate sectors are experiencing a gradual recovery amidst significant challenges, with expectations of steady growth in 2024. The economy is projected to expand by 5.8%, reflecting resilience despite global uncertainties. This growth is supported by a strong rebound in tourism, with international tourist arrivals reaching 6 million in the first 11 months of 2024, signaling a robust recovery in this vital sector. Additionally, trade and urban expansion continue to progress, contributing to overall economic momentum.

However, the path to recovery is not without obstacles. Financial stress remains a concern, as inflation is projected at 2.2%, and interest rates remain elevated, with commercial banks charging 10.82% on USD loans as of August 2024. Deposit rates have slightly declined to 5.15%, indicating tightening liquidity conditions. These factors, coupled with declining rental prices and cautious investor sentiment, highlight ongoing challenges within the real estate market.

Investment in construction reflects this cautious outlook, with $4.9 billion approved in the first 11 months of 2024, marking a year-on-year decrease. While growth continues across various real estate segments, investor confidence has yet to fully recover. Looking ahead, the market outlook for 2024 emphasizes stabilization, strategic investments, and gradual growth, as Cambodia navigates its recovery while addressing persistent economic and financial hurdles.

Economic Overview

Key Economic Indicators (2024)

Cambodia’s economy is set for promising growth in 2024, with a projected GDP growth rate of 5.8%, showing a year-on-year (YoY) increase. This upward trend is driven by stronger trade, an improving investment climate, and recovering tourism. However, inflation is estimated at 2.2%, reflecting a YoY decrease, which suggests better price stability and controlled cost-of-living expenses.

The banking sector is experiencing fluctuating interest rates. USD loan interest rates have risen to 10.82% (August 2024, YoY increase), making borrowing more expensive. Conversely, USD deposit interest rates have decreased to 5.15% (YoY decrease), potentially discouraging savings but boosting spending and investment.

Tourism, a key economic driver, is bouncing back with 6 million international arrivals in the first 11 months of 2024 (YoY increase). However, construction investment has experienced a slowdown, with $4.9 billion approved for projects, marking a YoY decline. These indicators reflect a mixed economic landscape where some sectors flourish while others face challenges.

Real Estate Market

Cambodia’s real estate sector is undergoing shifts as occupancy rates and rental prices decline across key segments:

- Office Spaces: Occupancy rate fell to 65.1%, with prime rent at $27.0 USD/SQM (both showing YoY decreases).

- Retail Sector: Occupancy rate dropped to 61.8%, and prime rent fell to $22.6 USD/SQM (YoY decrease).

- Condominiums: New launches have slowed down, with only 3,200+ units introduced (YoY decrease). However, high-end property prices remain stable at $2,650 USD/SQM.

- Serviced Apartments: New completions stand at 240+ units (YoY decrease), and Grade A rent has declined to $19.3 USD/SQM.

These trends suggest a cooling real estate market where demand remains weak, influencing rental rates and occupancy levels.

Construction Investment

Cambodia’s construction sector remains under pressure, with investment values steadily declining since 2019. The total investment dropped from over $5 billion to below $2 billion in 2024.

The number of construction projects has also declined significantly, falling from a peak of over 10,000 projects in 2019 to less than 4,000 in 2024. While residential housing continues to dominate, trade, tourism, and investment-related construction remain low.

Construction Projects on Hold

A growing number of construction projects are facing delays:

- Projects “On Hold” increased by 6.3% in 2024.

- Under-construction projects declined by 14.7%.

- Completed projects saw a 6.5% increase, indicating that some developments are being finalized despite the slowdown.

This trend suggests cautious investor sentiment and potential financial constraints affecting project completion rates.

Decline in Residential & Commercial Launches

Cambodia’s property market is witnessing a sharp downturn:

- Condominium project launches have steadily declined since 2019.

- Landed property launches peaked in 2019-2020 but are now falling sharply.

- Office & retail completions have dropped significantly post-2021.

This slowdown could be linked to weaker demand, rising costs, and cautious investor sentiment in the real estate sector.

Phnom Penh’s Growth

Phnom Penh, Cambodia’s capital, is undergoing significant urban expansion, rapidly transforming into a regional economic hub. Over the past two decades, the city has nearly doubled in size and population, positioning itself as a key player in Southeast Asia’s urban landscape.

A Growing Metropolis

In 2005, Phnom Penh covered 375 km² with seven districts and a population of 1.05 million. Fast forward to 2024, the city has expanded to 692.46 km², doubling its districts to 14, and housing 2.28 million residents.

Looking ahead to 2035, projections indicate an urban radius expansion of 100 km, with the population expected to reach 6 million—a nearly threefold increase within a generation.

Regional Comparison

To put Phnom Penh’s growth into perspective, the city is still smaller in size and population compared to its regional counterparts:

- Bangkok, Thailand spans 1,569 km² with 10.8 million people.

- Ho Chi Minh City, Vietnam covers 2,095 km² and houses 8.9 million residents.

Tourism Recovery

Cambodia’s tourism sector is experiencing a strong recovery:

- November 2024 vs. November 2023: 110% increase in tourist arrivals.

- November 2024 vs. November 2019: Still 9% below pre-pandemic levels.

However, Angkor ticket sales indicate that international tourism patterns have changed. Chinese tourist ticket sales plummeted by 1032%, followed by Japan (-98%), South Korea (-81%), and the U.S. (-59%). This shift reflects a need for diversified tourism markets beyond traditional sources.

Growth in Imports & Exports

Cambodia’s trade sector is growing steadily:

- Imports: $24.2 billion (2023) → $28.5 billion (2024) (+18% YoY).

- Top Import Sources: China (47.1%), Vietnam (14.6%), Thailand (12.1%).

- Exports: $22.6 billion (2023) → $26.2 billion (2024) (+16% YoY).

- Top Export Destinations: USA (37.9%), Vietnam (13.8%), China (6.7%).

These figures indicate stronger international trade relations, with Cambodia benefitting from increased demand for exports.

Chinese Loans & FDI

One of the most notable financial shifts in 2024 is Cambodia’s complete halt in receiving new loans from China as of Q3. This marks a significant shift in financing patterns, as Chinese loans have historically played a major role in Cambodia’s infrastructure development.

Chinese tourism has also plummeted dramatically from 2.3 million arrivals in 2019 to below 0.5 million by November 2024. Meanwhile, Chinese foreign direct investment (FDI) remains dominant but has been steadily declining:

- 2020: 51%

- 2021: 48%

- 2022: 52%

- 2023: 56%

- 2024 Q2: 47%

Despite the dip, China remains Cambodia’s largest investor, though diversification efforts may be needed to maintain investment inflows.

Banking Liquidity & Non-Performing Loans (NPLs)

Cambodia’s banking sector is seeing slower credit growth across most sectors, except construction, which recorded a growth rate exceeding 30%. However, wholesale & retail trade, real estate, and manufacturing continue to show slower but steady growth.

A major concern is the sharp rise in Non-Performing Loans (NPLs):

- Banks: 6.8% (2024 H1)

- Microfinance Institutions: 8.3% (2024 H1)

This rising NPL trend highlights increased financial risk and potential difficulties for borrowers in repaying loans.

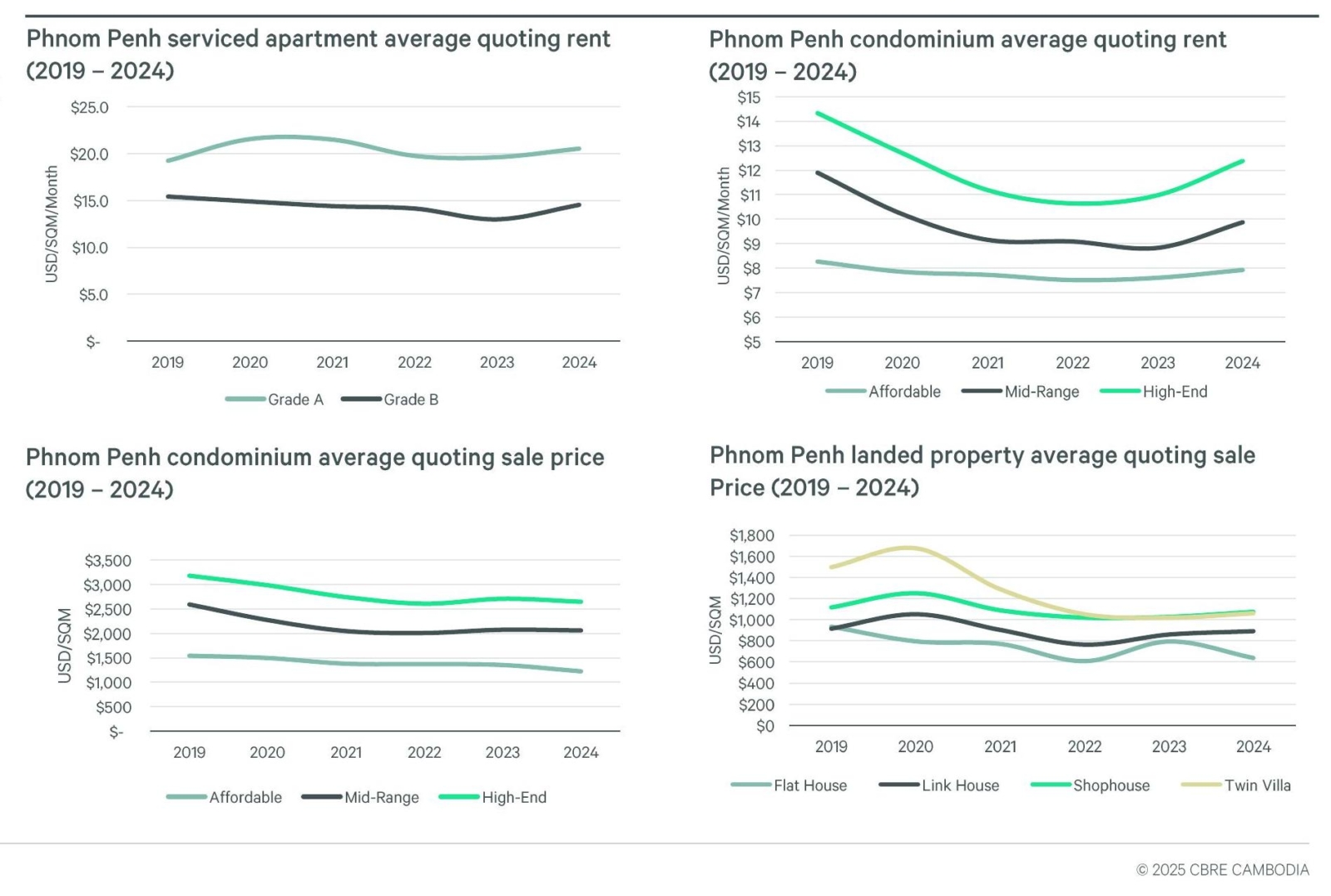

Residential Market

While rents show signs of stabilization, sale prices for condominiums and landed properties have decreased since 2019. However, high-end rental prices are starting to recover, indicating a potential market adjustment.

New Residential Project Launches in 2024

New residential developments in Cambodia include a mix of affordable and high-end projects across condominiums and landed properties.

Condominium Projects:

- L Tower TTP (Chamkarmon) – Affordable

- Time Square 7 (Toul Kork) – Affordable

- Picasso Sky Gemme (Boeung Keng Kang) – High-end

- Time Square 8 (Chamkarmon) – Affordable

Landed Property Projects:

- PH Eco Poli (Chbar Ampov) – High-end

- PH The Star Natural II (Mean Chey) – High-end

- PH Eco Poli II (Chbar Ampov) – High-end

- Park Land 598 – Extension (Russey Keo) – High-end

- Borey Sunny Toul Pongror (Dangkao) – Affordable

A strong emphasis on high-end landed properties is evident in these launches, signaling a shift in market focus.

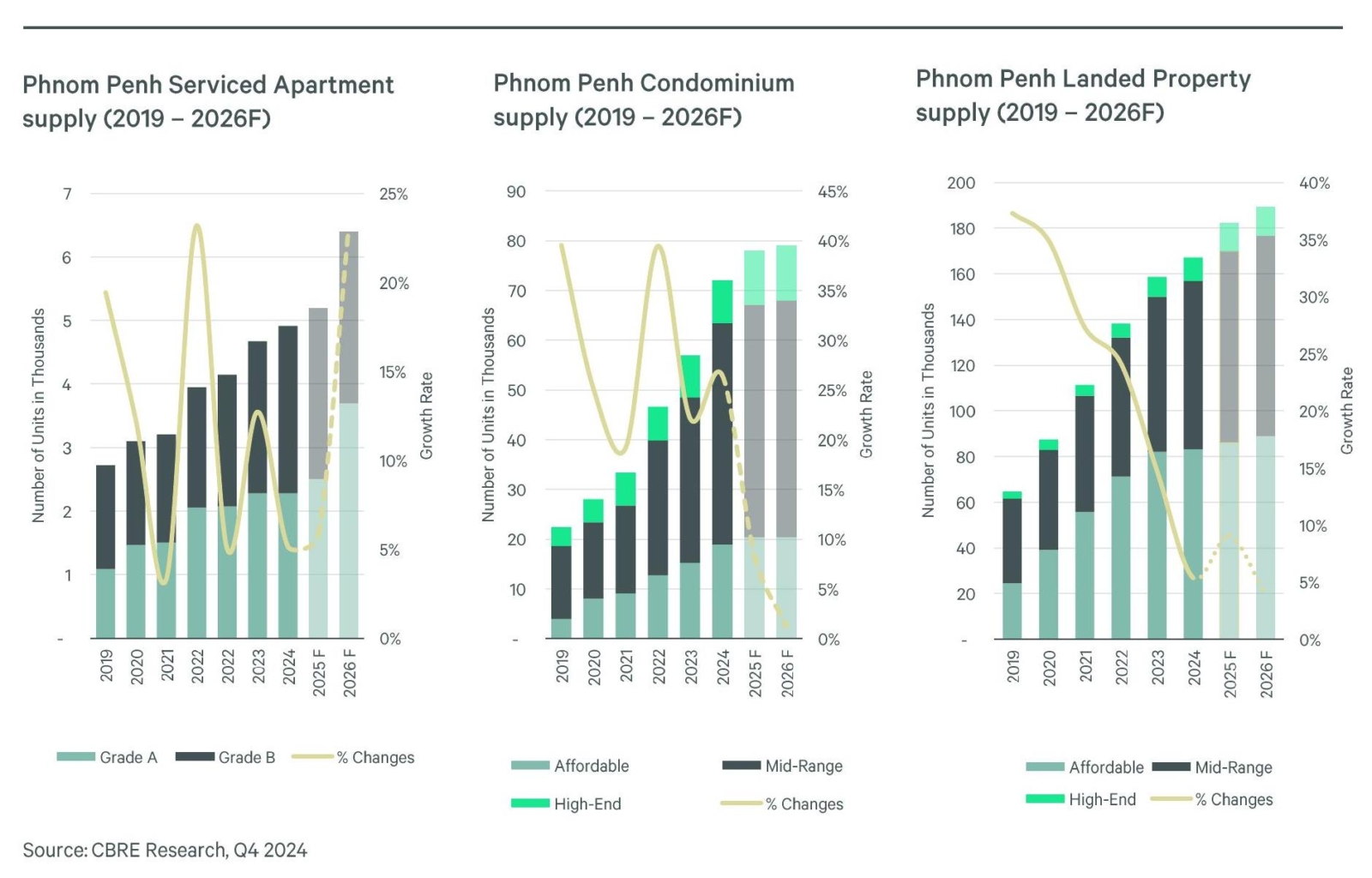

Completion Delays Push Supply to Slow Down

Real estate supply in Phnom Penh continues to expand, but growth rates are slowing down due to completion delays.

Forecasted Supply for 2024 & 2025:

- Serviced Apartments:

- 2024: 4,900+ units

- 2025 Forecast: 5,200+ units

- Condominiums:

- 2024: 72,000+ units

- 2025 Forecast: 78,000+ units

- Landed Properties:

- 2024: 167,000+ units

- 2025 Forecast: 182,000+ units

Despite a continued rise in supply, condominiums and landed properties are experiencing a slowdown in growth rates, indicating a potential market adjustment.

Rentals Recover Amid Stable Market Adjustment

Rental prices are stabilizing, while property sale prices have declined since 2019.

Key Rental & Sale Price Trends (2019–2024):

- Serviced apartment rents:

- Grade A: Stabilized at $18–$20 per sqm/month.

- Grade B: Declined but steady at $10–$12 per sqm/month.

- Condominium rents:

- Affordable units: Below $9 per sqm/month.

- High-end units: Declined but started recovering in 2024.

- Condominium sale prices:

- High-end condos dropped from $3,500 per sqm in 2019 to $2,500 per sqm in 2024.

- Mid-range and affordable condos followed similar trends.

- Landed property sale prices:

- Flat houses and link houses declined from $1,600 per sqm to around $1,000 per sqm.

- Shophouses and twin villas saw similar declines.

While sale prices remain lower, rents are showing signs of stabilization, particularly in the high-end serviced apartment and condominium market.

Commercial Market

- New commercial projects include a mix of retail podiums, office towers, and community malls.

- Retail supply remains stable, but Grade A office space is expanding rapidly.

- Office rents are declining, placing Phnom Penh among the weakest performers in Asia.

- Retail rents show no recovery, while occupancy rates continue to drop.

- Standalone stores remain dominant, and Chinese brands are aggressively expanding in Cambodia.

Completions and Upcoming Commercial Projects

Several major commercial projects are set to be completed in 2024, with additional developments coming in 2025.

Projects Completing in 2024:

- The Peak (Chamkarmon) – Retail Podium

- Booyoung Town Mall (Sen Sok) – Retail Podium

- Maline Office Park (Chamkarmon) – Centrally-Owned

- Versailles Square (Mean Chey) – Strata-Office

- Norea Center (Chbar Ampov) – Centrally-Owned

Upcoming in 2025:

- GDT Tower (Chroy Changvar) – Centrally-Owned

- Vue Aston (Chbar Ampov) – Retail Podium

- 60M Community Mall (Mean Chey) – Community Mall

- FTB Tower (7 Makara) – Centrally-Owned

- Chief Tower (Boeung Keng Kang) – Strata-Office

Retail podiums and centrally-owned office spaces dominate upcoming developments, reflecting a continued expansion of commercial real estate.

Retail Supply Stagnates, Grade A Office Expands Rapidly

Retail space supply is expected to remain stable, while Grade A office supply is set to triple by 2026.

Retail Supply Growth (2019–2026F):

- Currently around 700,000 sqm and projected to exceed 900,000 sqm by 2026.

- Shopping malls, community malls, and retail podiums remain the dominant formats.

Office Supply Growth (2019–2026F):

- Currently around 1 million sqm, with expectations to surpass 1.4 million sqm by 2026.

- Grade A office space is the fastest-growing segment, expected to triple in size.

The rapid increase in Grade A office space suggests growing investor confidence, despite slower growth in retail developments.

Grade A Office to Quadruple in Size

Several high-profile office developments are planned between 2025 and 2027, further solidifying Phnom Penh’s role as a commercial hub.

Major Grade A Office Developments (2025–2027):

- GDT Tower (Chroy Changvar)

- Royal Group Central (Daun Penh)

- Odom Tower (Chamkarmon)

- FTB Tower (7 Makara)

- Royal Group HQ (Unofficial Name) (Daun Penh)

- Khou Tower (Daun Penh)

- Norodom Business Tower (Daun Penh)

With seven major Grade A office projects in the pipeline, Phnom Penh’s premium office market is set to expand significantly.

Phnom Penh Office Rents Decline While Regional Markets Surge

Despite growth in office space, rents in Phnom Penh continue to decline, whereas most Asia-Pacific markets are experiencing rent increases.

Office Rent Trends (2019–2024):

- Grade A office rents fell from around $30 per sqm/month to below $25 per sqm/month.

- Grade B and C office spaces followed similar downward trends.

Regional Market Comparison (2021–2024):

- Cities like Mumbai, Sydney, and Singapore saw over 10% rent increases.

- Phnom Penh experienced a notable decline, aligning with Beijing and Shenzhen as some of the weakest performers in the region.

Falling office rents indicate weak demand for office spaces despite increasing supply.

Retail Rents Show No Sign of Recovery

Retail rents continue to struggle in Phnom Penh, declining consistently since 2019.

Retail Rent Trends (2019–2024):

- Shopping malls and retail podiums have seen rental rates fall to $15–$25 per sqm/month.

- Community malls and prime high streets also experienced steady declines.

Regional Comparison (2023–2024):

- Hanoi, Ho Chi Minh City, and Hong Kong SAR experienced 10–15% retail rent growth.

- Phnom Penh remains one of the few cities where rents continue to decline, struggling to recover post-pandemic.

Retail landlords face challenges in tenant demand, while other Asian markets are seeing stronger retail recoveries.

Both Retail & Office Occupancy Drop

Occupancy rates for both retail and office spaces have declined, reflecting weakened demand.

Current Occupancy Rates (2024):

- Retail occupancy: 61.8%, down from 64.4% in 2023.

- Office occupancy: 65.2%, slightly down from 66.4% in 2023.

- Shopping mall occupancy: 71.6%, indicating higher resilience compared to general retail spaces.

The gradual drop in occupancy levels highlights slower leasing activity across both sectors.

Standalone Stores Remain Popular, Chinese Retailers Expand into Cambodia

Standalone retail locations remain the most preferred choice, while Chinese brands continue to enter the Cambodian market.

Retail Location Preferences (2024):

- Standalone stores dominate across all retail categories, from food & beverage to fashion.

- Shopping malls and retail podiums hold a smaller share, reflecting a shift towards independent retail spaces.

Key Chinese Retailers Expanding into Cambodia:

- HEEKCAA (Beverages)

- MIXUE (Ice Cream)

- TANYU (Hotpot)

- BYD (Electric Vehicles)

- Chinese fashion and beauty brands expanding globally

Chinese companies are increasing their presence in Cambodia, dominating sectors like F&B, fashion, and EVs.

This article is based on the CBRE Reasearch published in Feb 2025. You can download full report from here: https://cbre.com.kh/research-center/downloads/fearless-forecast-2025-cbre-cambodia/

Ta strona jest także dostępna w językach:

![]() Polski (Polish)

Polski (Polish)